|

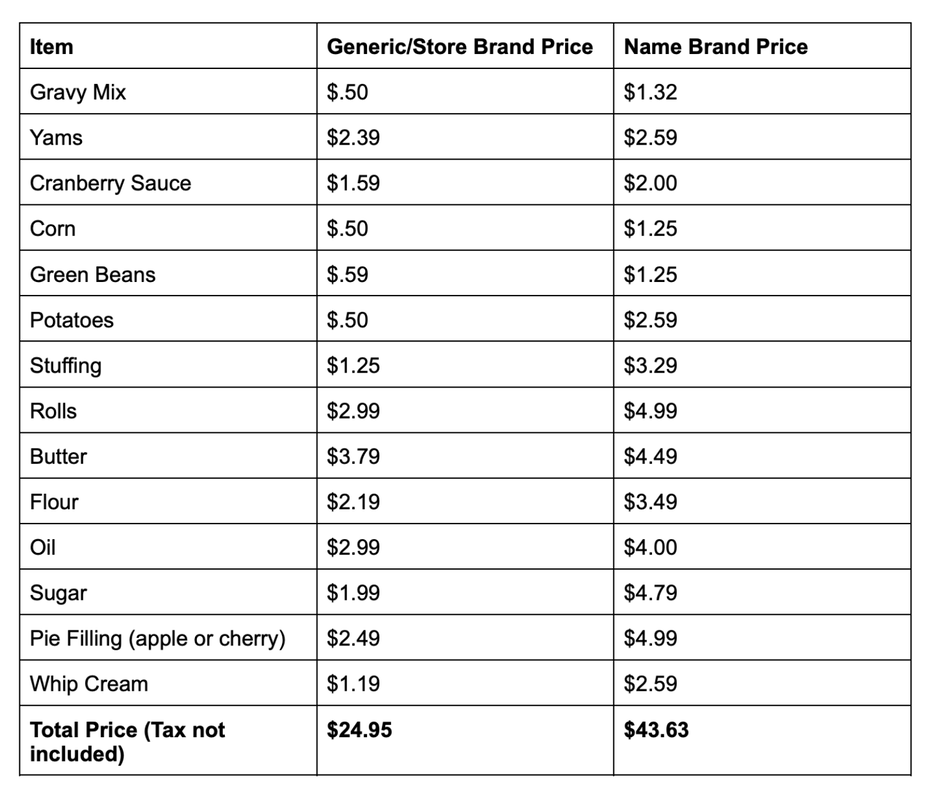

Alicia Nelson-Bell, HCHC Empowering Financial Wellness Program Coordinator Will your holiday meals look the same this year? Inflation has been hitting everyone to some level or another these last few months. One area that we have all been noticing the effects of inflation is at the grocery store, making it harder and harder to stick to our grocery budgets and our overall budget. As of July of this year, grocery prices have increased an average of 13.5%. Because of this, you may be wondering if it is possible to still have the same caliber of holiday meal and celebration. In addition to divvying up food responsibilities among all the guests, there are some other simple things you can do at the grocery store to keep holiday meals from busting your budget even with the high inflation. Like with any type of holiday shopping, it is important to take an inventory of what you already have and plan out what you still need to buy so you can make your shopping experience most purposeful and not have to make as many trips to the grocery store (which is an opportunity for impulse buys). Today we are going to focus on the power of buying generic brand items for your meals this holiday season. Up to 50% Savings at the Grocery Store? Yep, you read that right. There’s a simple way to save up to 50% at the grocery store without using coupons or the weekly ads (which I still love doing :)). This simple way can help you still have an enjoyable and tasty holiday season this year without really sacrificing any of the fixings, even despite inflation. This simple tip, which is one of the action items for this month in the 2022 Finance Calendar, is simply buying generic at the grocery store this holiday season. Something not commonly known is that many of the store/generic brand items are produced with the same ingredients and even in the same production facilities. This means that most of the time you won’t taste or notice much of a difference other than the packaging. I understand that there are some things that you will notice a difference in taste that you may want to stick with the name brand on, but like I mentioned, even going generic on some of your grocery items can save you a good chunk of money. If your family were to switch out some of the ingredients in some of your meals, each week you could save around $20 or around $80 a month. Over the course of the year this would be a little more than $1,000 just by making this simple switch. Below you will see a price comparison chart for most of the items that are known as typical “fixings” for a holiday meal. As you can see, even small savings on individual items can add up to be pretty noticeable. The example below shows a savings of around $20 by purchasing generic or store brand items rather than name brand. Continue these habits throughout the year for a simple way to see savings add up at the grocery store! Example below may not reflect prices in your area:  PRO TIP: To see the greatest savings, look above and below the typical eye level, since stores strategically put the most expensive brand products at eye level.

0 Comments

Alicia Nelson-Bell, Empowering Financial Wellness Program Coordinator I’m sure that over the course of the last year we have all seen that our grocery money doesn’t buy us as much as it used to. Because of this, it is even more important to be strategic in how we use our funds at the grocery store so we can meet our family’s needs without breaking the budget. Grocery budgets are a variable expense and with prices going up and up on many items at the store, let me share a simple tip that thousands of other people have found successful to save money on the food you buy.

Carrie M. Durward, PhD, RD Nobody would just throw money in the garbage, but that is essentially what we do every time we waste food. It is something we all do! Recent research showed that the average American consumer wastes about one pound of food every day! That adds up to over $1,300 per year on food that goes in the garbage. That’s a lot of money! Food waste may seem inevitable, but you can significantly reduce this amount by simply changing a few of your habits. To learn how you can stop wasting food and start saving money, visit USU Extension Food Waste Series. You can also join us on Facebook at USU Extension Nutrition where we will be highlighting ways to reduce food waste all month.

April is National Food Waste Awareness month, and USU Extension Nutrition has developed a series outlining best practices and research-based solutions to help you prevent food waste. This series will help you learn how to meal plan, grocery shop, preserve fruits and vegetables, and use up leftovers in your home. They’ve provided various resources to make saving money and decreasing food waste in your home a breeze! Carrie M. Durward, PhD, RD, is a USU Extension Nutrition Specialist and Associate Professor in the Department of Nutrition, Dietetics and Food Sciences. References: Conrad, Z. (2020). Daily cost of consumer food wasted, inedible, and consumed in the United States, 2001–2016. Nutrition Journal,19(1). Guest Contributor: Christina Pay, USU Extension Assistant Professor  There are three shopping events each year in Utah that savvy shoppers look forward to with anticipation. These are known as case lot sales. Generally occurring in January, March and September, buying pantry items at case lot prices can save you money while helping you stock up on items you use on a regular basis. However, don’t be fooled. Without a plan you may end up spending more money than saving it, so follow the tips below to help you make your own plan to find the best case lot bargains. GUEST CONTRIBUTOR: ELIZABETH DAVIS, USU EXTENSION ASSITANT PROFESSOR  One of the greatest assets that we have is our own health. When we are healthy it is easy to take it for granted and assume that we will always have the energy, strength, and ability to do the things that are important to us. Eating well, exercising and getting enough sleep are all an important part of taking care of our bodies. Unfortunately, sometimes we let the “cost” of being healthy get in the way. For example, I have heard from many people that they can’t afford to eat healthy. In order to preserve our health, it is important to recognize that we can successfully eat healthy even on a tight grocery budget. Here are a few simple tips from nutrition Blogger Brittney Johnson to help you decrease your spending and increase your family’s health and longevity. |

TAKE A FREE CLASS!Host a ClassamandaSharing real-life money smarts to help you stay on track with financial goals while still enjoying life! Follow the fun on InstagramAS SEEN ONawardsBest of State 2022 & 2023: Personal Finance Education

1st Place National Award in Social Media Education from the National Extension Association of Family and Consumer Sciences

Gold Award in Blog Site category at the 7th annual Education Digital Marketing Awards.

Platinum Award in Digital Media, Web Design category at the International Marketing and Communication Awards.

Categories

All

|