|

According to debt.org, in 2018 Americans had a combined total of $13.51 trillion of debt. This number is $837 billion above the previous high! So, if you are one of the many contributing to that $13.51 trillion of debt, here's a resource you've got to know more about: PowerPay. PowerPay shows you the most efficient and money-saving way possible to get out of debt. First of all, to use PowerPay you’ll need to create an account. Head to powerpay.org and click “New? Sign Up Now” to get started. It shouldn’t take you more than a few minutes to get your account set up. You can also use the free app on your Apple smart phone. Once it’s up and running here’s what you’ll need to gather:

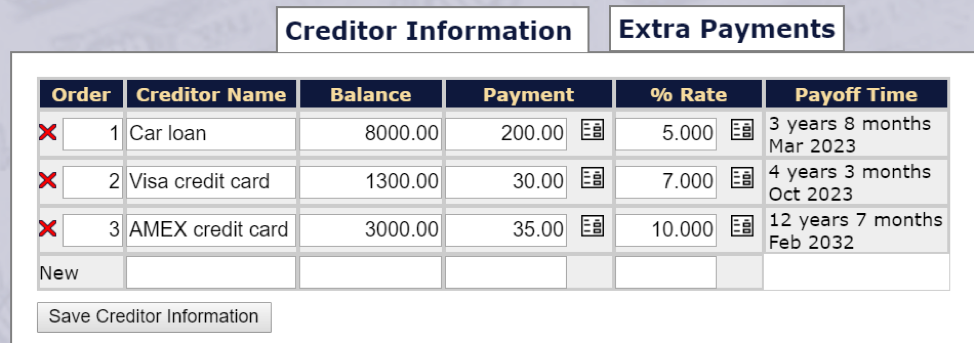

Entering in this information will automatically calculate when you will be out of debt and how much you’ll pay in the end. It will also calculate how to get out of debt using the PowerPay method.

Here’s how the PowerPay method works:

When you are on the payment calendar page, scroll down to see the PowerPay detailed calendar. You will notice that the payment amounts on each loan stay the same until one loan is paid off. Notice which loan gets the larger payment first. Follow this calendar and continue to pile on payments and you’ll get out of debt as fast as possible! After you’ve looked at the calendar, scroll back up to the top to see the comparison between using PowerPay and not using PowerPay. Especially notice how much you’ll save in interest! The key to successfully using the PowerPay method is to not accrue any more debt while you are trying to pay off the debt you already have. Lock away your credit cards if you have to! If you stick to the calendar and you don’t accrue any more debt, using PowerPay will save you a lot of time and money. There are also a lot of other great resources on powerpay.org including a Spending Plan, PowerSave, financial calculators, and an education center. The site is in the process of being revised so check back often to see what's new!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

TAKE A FREE CLASS!Host a ClassamandaSharing real-life money smarts to help you stay on track with financial goals while still enjoying life! Follow the fun on InstagramAS SEEN ONawardsBest of State 2022 & 2023: Personal Finance Education

1st Place National Award in Social Media Education from the National Extension Association of Family and Consumer Sciences

Gold Award in Blog Site category at the 7th annual Education Digital Marketing Awards.

Platinum Award in Digital Media, Web Design category at the International Marketing and Communication Awards.

Categories

All

|